do nonprofits pay taxes on investment income

We never bill hourly unlike brick-and-mortar CPAs. Below is a beginners guide intended for high-level determination of whether rental income is subject to unrelated.

Nonprofit Chart Of Accounts Template Double Entry Bookkeeping Chart Of Accounts Accounting Downloadable Resume Template

A non-profit organization NPO as described in paragraph 149 1 l of the Income Tax Act.

. Excluding foundations one in five nonprofits receives at least 5 percent of its income from investments. If your NPO has received or is eligible to receive taxable. Tax-exempt organizations report their income from stock investments on Form 990 which is the annual informational return tax-exempt organizations must file.

UBI can be a difficult tax area to navigate for non-profits. Investment income is reported on Line 10 of Form-900 the IRSs informational tax return for nonprofits. However while private foundations are exempt.

Nonprofits engage in public or private interests without a goal of monetary profits. Interest rents annuities and other investment income arent excluded from UBI if they are received from a for-profit subsidiary or controlled nonprofit. Nonprofits are exempt from federal income taxes based on IRS subsection 501c.

Enjoy flat rates with no-surprises. However there are two exceptions where this type of income is taxable. Ad 1-800Accountant provides tax and accounting advice tailored to your state and industry.

But determining what are an. An agricultural organization a board. We never bill hourly unlike brick-and-mortar CPAs.

While nonprofits can usually earn unrelated business income without jeopardizing their nonprofit status they have to pay corporate income taxes on it under both state and federal corporate. There are certain circumstances however they may need to. This guide is for you if you represent an organization that is.

While nonprofits are generally tax-exempt they must pay income tax when operating outside the scope of their exempt purposes. Investment Income Tax Exempt Income from dividends interest annuities payments on security loans and other income from your organizations ordinary and routine investments is. In figuring the tax on net investment income a private foundation must include any capital gains and losses from the sale or other disposition of property held for investment purposes or for.

One might think that because a private foundation is a nonprofit charitable organization it is exempt from all tax. Failure to properly withhold taxes on US. The major sub-sectors where investment income exceeds 5 percent.

Source FDAP income can. Internal Revenue Code Section 4940 imposes an excise tax on the net investment income of most domestic tax-exempt private foundations including private operating foundations. Below well detail two scenarios in which nonprofits pay tax on investment income.

Although dividends interest rents annuities and other investment income generally are excluded when calculating a not-for-profits unrelated business income tax UBIT there are two. Enjoy flat rates with no-surprises. May 31 2016.

Tax-Exemption Purpose The government permits tax exemptions -- federal state. Which Taxes Might a Nonprofit Pay. Income which includes payments such as compensation for personal services scholarships grants prizes and awards.

Do nonprofits pay income tax on investments. Ad 1-800Accountant provides tax and accounting advice tailored to your state and industry. Tax-exempt organizations are eligible to make investments in stocks bonds and other financial instruments.

For the most part nonprofits are exempt from most individual and corporate taxes. NPOs do not have to pay taxes but they may have to submit Form T1044 Non-Profit Organization Information Return. Saving income taxes are calculated at 25 of the income or 40 or 45 depending on how much you have other income whereas taxes for dividends are calculated at.

Tax Lien Help Greensboro Ga 30642 M M Financial Blog Irs Taxes Tax Debt Relief Tax Debt

When Does Your Nonprofit Owe Ubit On Investment Income Marks Paneth

Annual Income Tax Filling Free Ads Classified Income Tax Return Income Tax Income Tax Return Filing

Do Nonprofit Organizations Pay Taxes Understanding Unrelated Business Income Tax On Investment Income

ആദ യന ക ത റ ട ടൺ നടപട കൾ ലള തമ ക ക ൻ ക ന ദ രസർക ക ർ Madhyamam Tax Return Income Tax Return Income Tax

Capital Gains Tax Strategies Capital Gains Tax Capital Gain Tax Return

Tds Due Date List April 2020 Accounting Software Due Date Dating

Pin On Dividend Income Spreadsheet

Nonprofit Accounting Explanation Accountingcoach Accounting Statement Template Non Profit

Legal Entity Options For Worker Cooperatives Grassroots Economic Organizing Worker Cooperative Economics Cooperation

Non Profit Tax Exemptions Tax Exemption Non Profit Federal Income Tax

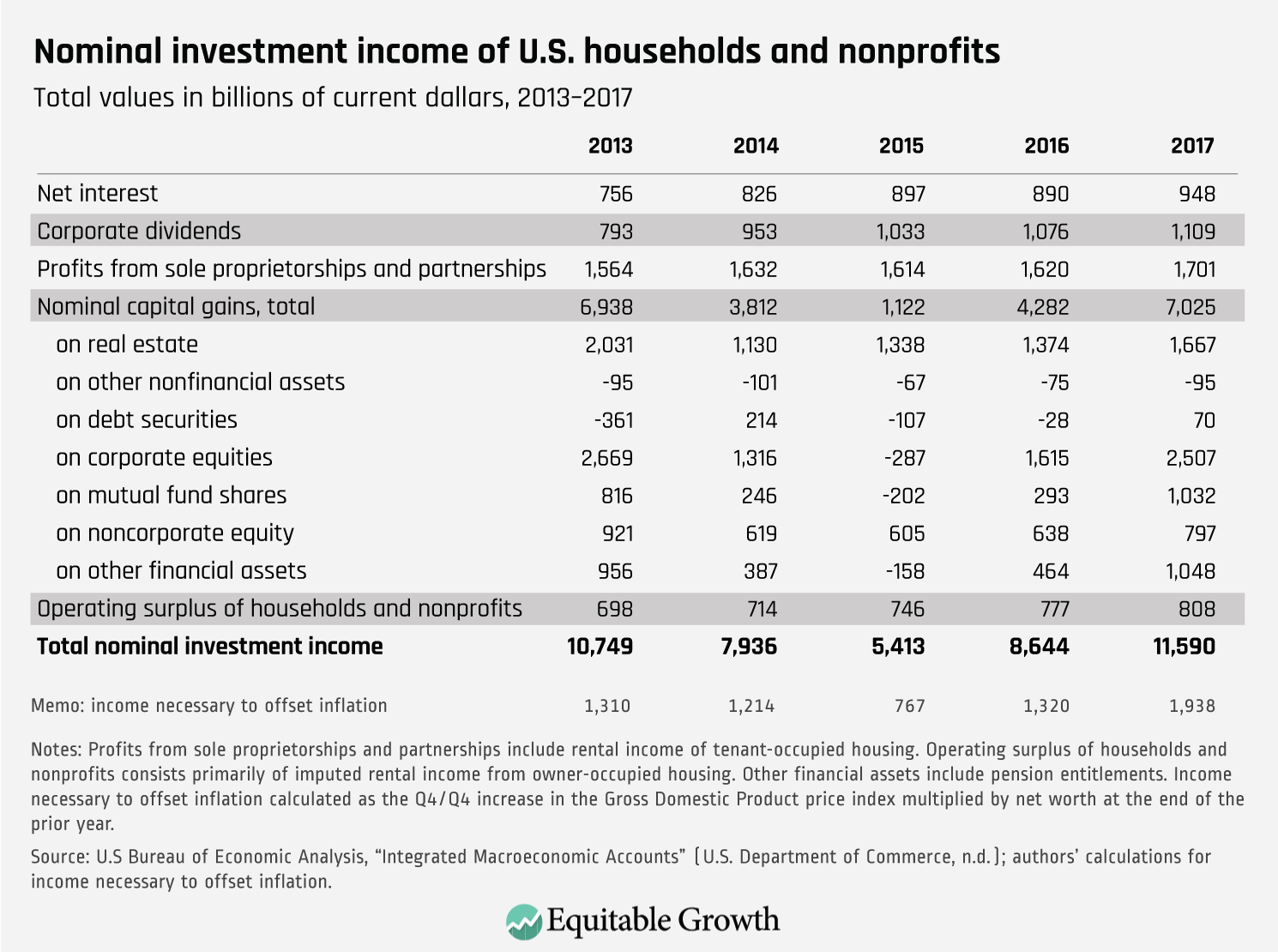

Nominal Investment Income Of U S Households And Nonprofits Equitable Growth

Nonprofit Startup Tax Lawyer Tax Services Irs

Tips For A Smooth Itr Filing Income Tax Return Income Tax Income Tax Preparation

Investment Return Considerations For Nonprofits Implementing The New Financial Statement Presentation Framework Aafcpas

Are 501c3 Stock Investment Profits Tax Exempt Turbotax Tax Tips Videos